India is the largest democracy in the world. Indian Government is responsible for providing safety, security, and infrastructure to its people along with maintaining law and order in the country. Given the population of the country and the regional and religious diversities, the roles and responsibilities of the Indian government are of unimaginable scale and complexity. This mega task of taking care of our country requires highly skilled people and huge sums of money.

Although there are multiple sources of revenue with the Indian government, the major source of money is tax. TAX is a financial obligation of the citizens of the country towards the government. Tax is collected by the government and it enables the government to maintain the safety and security of the country by ensuring that the country’s defense is well-equipped.

Tax enables the government to develop the country’s infrastructure so that its citizens will get ample opportunities for business growth. In other words, Tax is the fuel that runs the engine of the country.

Table of Contents

Overview of Indian Taxation Structure

There are two basic types of taxes collected by the Indian government.

- Direct Tax: It is the tax that is levied on the income of individual and corporate entities. The responsibility to assess and deposit the amount of tax liability is on the individual or corporate entities itself.

- Indirect Tax: It is the tax that is levied on the sell of goods and the provision of services. The responsibility to assess, collect and deposit the amount of tax liable on goods sold and services provided is on the seller itself.

- Other Tax: These taxes are levied by the Central government to serve a specific purpose and are imposed on both direct and indirect taxes. Swachh Bharat cess, Infrastructure cess and Krishi Kalyan cess are part of this category of tax.

These taxes are collected either by The Central Government or the State Government and some fraction of it is collected by the local Municipalities. Let’s further understand the individual category in detail.

1. Direct Taxes

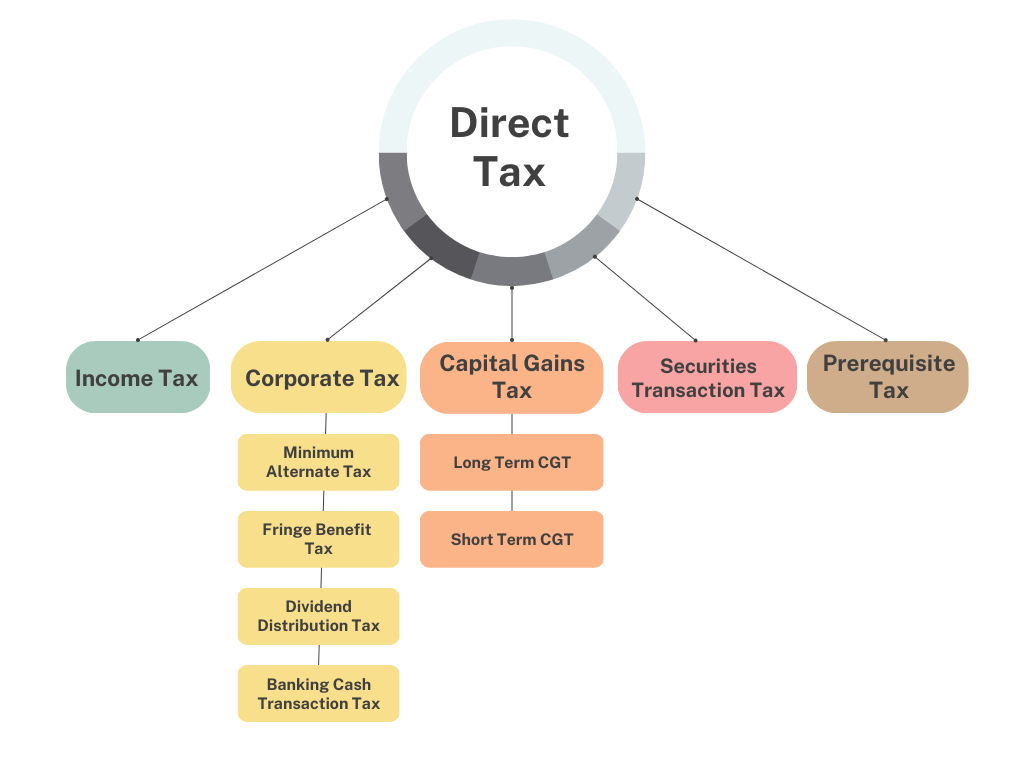

As explained earlier, Direct taxes are imposed on individual and corporate entities. These taxes are non-transferable. The Direct Taxes can be further classified into the following categories (refer to the family tree).

- Income Tax: It is the primary source of revenue for the central government and is levied on the taxable income of individual or business entities at defined rates. Taxable income refers to the income above a specified limit set by the government in the yearly budget from which the expenses and other deductions are reduced. The current year FY 2023-24 Tax slabs are as follows:

| Tax Slab | Rates |

| Rs. 0 to 3 Lakhs | NIL |

| Rs. 3 Lakhs -6 Lakhs | 5.00% |

| Rs. 6 Lakhs – 9 Lakhs | 10.00% |

| Rs. 9 Lakhs – 12 Lakhs | 15.00% |

| Rs.12 Lakhs – 15 Lakhs | 20.00% |

| Rs. 15 lakhs and more | 30.00% |

- Corporate Tax: These taxes are levied from Domestic companies as well as foreign companies. Domestic companies i.e., the companies which are controlled and managed within Indian geographical boundaries are charged on their universal income. And Foreign companies are taxed on their income accrued in India.

| Type of a company | Corporate Tax rate | Surcharge on Net Income | |||||

| < 50 Lakhs | 1 Crore > Net Income > 50 Lakhs | 2 Crore > Net Income > 1 Crore | 5 Crore > Net Income > 2 Crore | 10 Crore > Net Income > 5 Crore | > 10 Crore | ||

| Domestic annual turnover up to Rs 250 Crore | 25% | NIL | 10% | 15% | 25% | 37% | 37% |

| Domestic Company turnover more than Rs 250 Crore | 30% | NIL | 10% | 15% | 25% | 37% | 37% |

| Foreign Companies | 40% | NIL | 2% | 2% | 2% | 2% | 5% |

- Capital Gains Tax: It is levied by the government on the profit that an individual or company makes by selling an asset. Profit on asset sell or capital gain is the amount by which the asset is appreciated during the time it was held. Capital gains are taxed based on the period for which the asset is held with the owner before selling it. The duration for Short-Term Capital Gain is not more than 36 months and it is taxed at a rate of 15% and Long-Term Capital Gain is taxed at 20% rate.

- Securities Transaction Tax: It is tax payable on the value of securities transacted (paid or received) through recognized stock exchange transactions.

- Perquisites Tax: Perquisite as defined by the income tax department of India, is any casual emolument or benefits attached to an office or position in addition to salary or wage. It includes the value of rent-free/accommodation or concession in the matter of rent or any benefits provided by the employer, security or shares allotted by an employer, or any fringe benefits and amenities provided.

2. Indirect Taxes

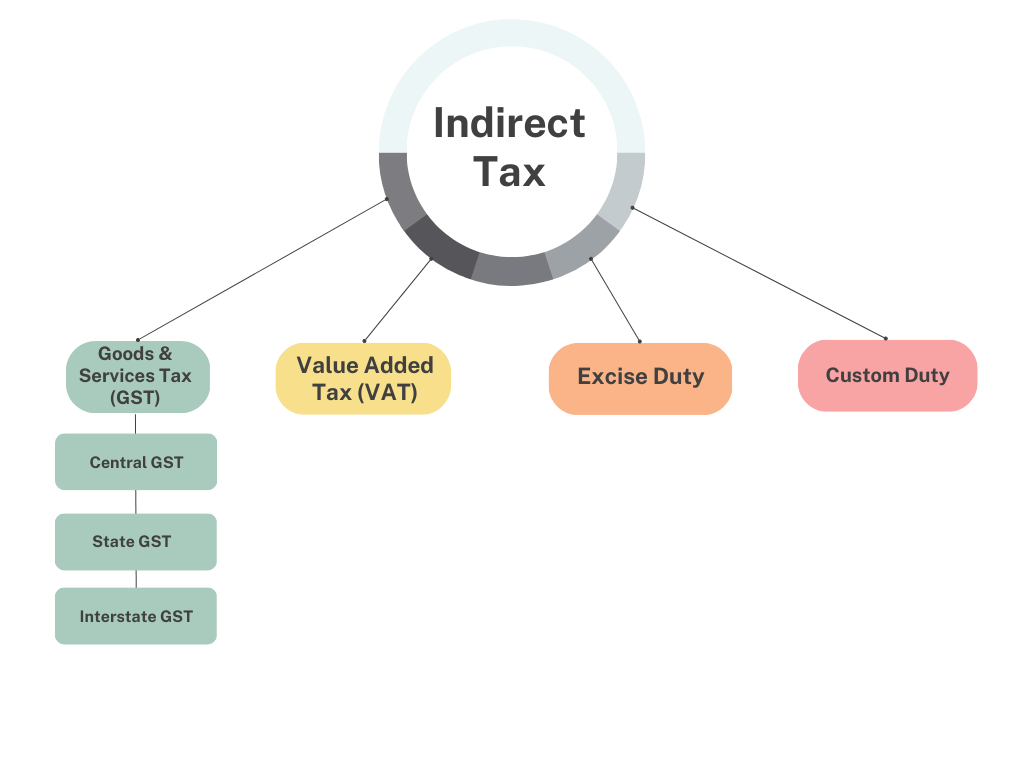

As already defined, Indirect taxes are levied upon the consumption of goods and services. It is an indirect tax in the sense that it is not directly levied on the income of a person or company. The consumer of the Goods and services has to pay an extra amount (i.e., indirect tax amount) to the seller at the time of the transaction. It is the duty of the seller to deposit the collected amount to the government. The person who pays the tax and the person who deposits it to the government are different. Indirect taxes can be broadly classified into the following types.

- Goods & Services Tax (GST): GST was implemented in the year 2017 and it is one of the most revolutionary steps taken by the Indian government in the history of our constitution. As the name suggests, it is the tax levied upon the supply of goods or services. Before GST, several taxes were levied at different stages of the supply chain process for example: Tax by Manufacturers (Central excise duty), provision of service (Service Tax), interstate sale of goods (CST), retail sales (VAT), Entry of goods in the state (Entry Tax), Luxury tax, Purchase Tax, etc. these resulted in a multiplicity of taxes levied in a single supply chain. After GST, all taxes mentioned above are combined and are to be submitted in single tax called Goods and Services Tax. GST has a dual levy structure where, the central government will collect Central Goods and Services Tax and interstate supply tax i.e., Integrated Goods and Services Tax and the state government will collect State Goods and Services Tax. The rate at which the goods and services are taxed is subjective. The implementation of GST has immensely increased the ease of doing business at all stages of the supply chain system.

- Value Added Tax (VAT): After the implementation of GST, VAT is not collected on goods and services, however, some unique products are kept out of GST provision and are still charged VAT. Value-added tax is charged on gross margin at every stage in sale of goods for this product. The list of items included in the VAT provision is petroleum products, products containing alcohol, etc.

- Excise Duty: Similar to VAT, Excise duty is subsumed under GST for most products and services but is levied on petroleum and liquor products.

- Custom Duty: It is a tax that is imposed on the import and export of goods. It is levied by the government to increase revenue and to safeguard domestic industries. It is further classified into:

- Basic Custom Duty (BCD)

- Countervailing Custom Duty (CVD)

- Additional Custom Duty or additional CVD

- Protective Duty

- Anti-dumping Duty