If you’ve ever tried to analyze market charts, you’ve probably noticed that prices don’t move in straight lines. They rise and fall, often in patterns that seem confusing at first. You might find yourself wondering how traders figure out when a price might reverse or continue its trend. That’s where the concept of Fibonacci retracement comes in. It’s a tool that helps traders identify possible levels where prices could pause or bounce back.

For beginners, understanding this can make a big difference in making smarter trading decisions instead of guessing where the market might go next.

Understanding What Fibonacci Retracement Means

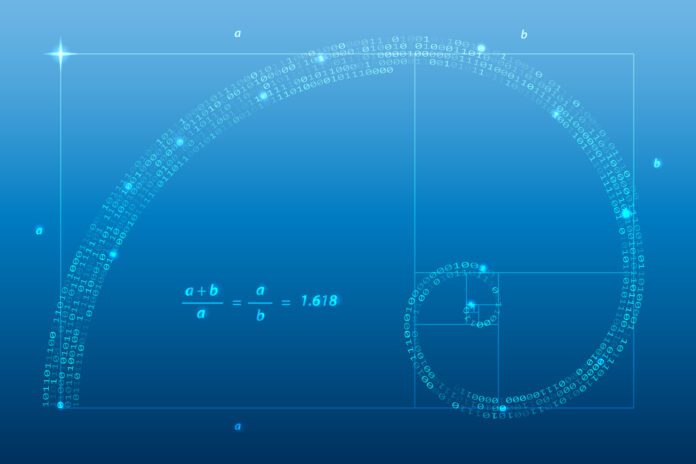

Before you can use it, you first need to understand what Fibonacci retracement actually is. It’s based on a sequence of numbers discovered by a mathematician named Leonardo Fibonacci, where each number is the sum of the two before it. From this sequence, traders use specific ratios like 23.6%, 38.2%, 50%, and 61.8%.

These percentages are then applied to market charts to find potential support and resistance levels. When you apply Fibonacci retracement lines to a chart, they show areas where a price might temporarily reverse or consolidate before continuing its trend.

Why Traders Use Fibonacci Retracement Levels

Now that you understand what it is, you might wonder why it’s so popular among traders. The main reason is that financial markets often behave in patterns. Many investors believe that these retracement levels reflect natural points of pause or correction during price moves.

When the price of a stock, cryptocurrency, or commodity rises too quickly, traders expect it to pull back slightly before moving upward again. Fibonacci retracement levels help identify where that pullback might end. They’re not always perfect, but they provide useful reference points for managing risk and planning entries or exits in trades.

How to Apply Fibonacci Retracement to Your Charts

Using this tool is not as complicated as it might sound. You start by identifying a recent high and low point on your chart. If the market is in an uptrend, you’ll draw the retracement from the lowest point to the highest point.

If it’s a downtrend, you’ll do the opposite. The charting software then automatically marks the retracement levels between these points. When prices begin to move, you can observe how they react to these levels. If the price pauses or reverses at one of them, it could signal a potential trading opportunity.

Common Mistakes Beginners Make

A common mistake among beginners is assuming that these levels are guarantees. They’re not. Just because a retracement level appears on your chart doesn’t mean the price will stop there. Markets can easily break through these levels if strong buying or selling pressure exists. Another mistake is placing the retracement tool on the wrong points of the chart, which gives misleading results.

Beginners also tend to ignore the broader trend, focusing too much on short-term reversals. To avoid these pitfalls, it’s important to combine Fibonacci retracement with other forms of analysis, such as trend lines or moving averages.

Building Confidence Through Practice and Patience

Like any trading strategy, getting comfortable with Fibonacci retracement takes time. The more charts you analyze, the better you’ll become at spotting patterns and understanding how prices respond to these key levels. You’ll learn that while the tool isn’t foolproof, it’s valuable for improving your timing and discipline as a trader.

Patience is essential because markets don’t always move predictably. With regular practice and consistent observation, you’ll start recognizing how Fibonacci retracement fits naturally into price action, helping you make informed, confident trading decisions.

Also read – Learning at Your Own Pace: The Rise and Benefits of Online Creative Courses